FTX contagion spreads as BlockFi crypto firm files for Chapter 11 bankruptcy

11/29/2022 / By Ethan Huff

First it was Celsius. Then it was Voyager, FTX, and Alameda. Now BlockFi is filing for bankruptcy as cryptocurrency scams continue to unravel one after another.

Reports indicate that BlockFi filed for Chapter 11 bankruptcy protection in the United States Bankruptcy Court for the District of New Jersey almost immediately following the implosion of FTX.

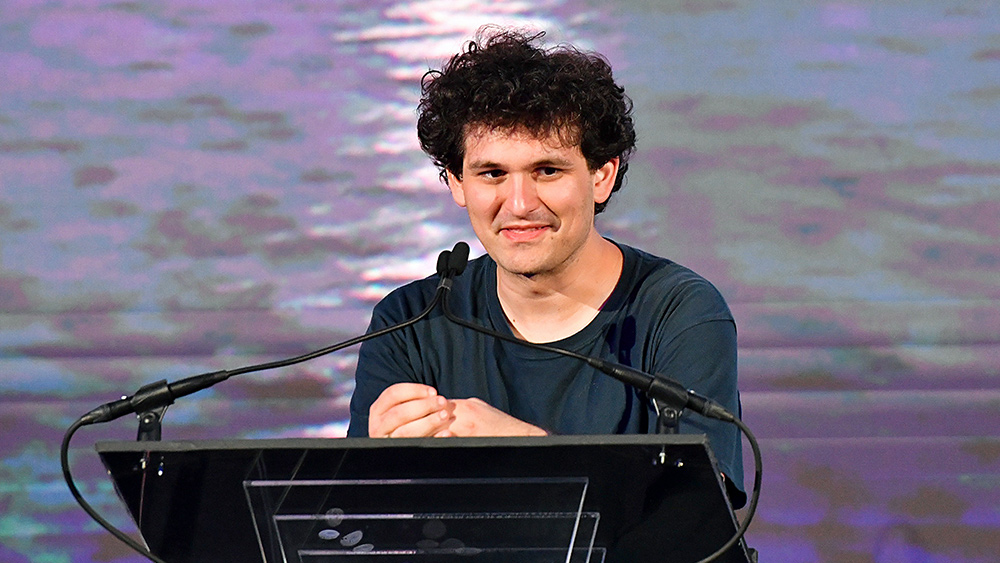

The filing suggests that BlockFi had more than 100,000 creditors with liabilities and assets ranging from $1 billion to $10 billion. There is also an outstanding $275 million loan to FTX US, the American arm of Sam Bankman-Fried’s (SBF) crumbled crypto scam.

In tandem with the American filing, BlockFi’s Bermuda subsidiary is also filing for bankruptcy. (Related: FTX and Alameda were a frontrunning scam that ripped off investors while fueling deep state globalism.)

“Bermuda, like the Bahamas, has embraced crypto as the future of finance,” reports CNBC. “Both established frameworks to deal specifically with crypto assets and digital currencies.”

“Both the Bahamas, with FTX’s bankruptcy, and now Bermuda, with BlockFi’s, face the first significant legal tests of their crypto regulations.”

The bankruptcy filing from BlockFi also shows that the company’s biggest client currently has a balance of nearly $28 million, as well as a $30 million settlement with the Securities and Exchange Commission (SEC).

“BlockFi looks forward to a transparent process that achieves the best outcome for all clients and other stakeholders,” said Mark Renzi of Berkeley Research Group (BRG), which is BlockFi’s financial advisor.

An additional 130 affiliated firms participating in BlockFi’s bankruptcy proceedings

Following the collapse of Three Arrows Capital earlier this year, BlockFi, which is both a crypto trading exchange and an interest-bearing custodial service for an array of cryptos, experienced almost immediate liquidity issues.

At the time, BlockFi had already halted withdrawals of customer deposits, admitting in the process that it had “significant exposure” to FTX and Alameda.

“We do have significant exposure to FTX and associated corporate entities that encompasses obligations owed to us by Alameda, assets held at FTX.com, and undrawn amounts from our credit line with FTX.US,” BlockFi said at the time.

People “familiar with the matter” say that in the days following FTX’s bankruptcy filing, BlockFi started talking with restructuring professionals. The company was last valued at around $4.8 billion, according to PitchBook.

Back in July, FTX tried to kick the can of BlockFi’s inevitable bankruptcy by creating a $400 million revolving credit facility. FTX also, at one point, considered trying to buy BlockFi.

About 130 additional firms are also involved in BlockFi’s bankruptcy proceedings. New FTX CEO John Ray said in a Delaware Bankruptcy Court filing that “in his 40 years of legal and restructuring experience,” he has never seen “such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.”

Ray also served as the new CEO of Enron following that company’s implosion.

In the few days following FTX’s November 11 bankruptcy filing, the company’s $32 billion valuation plummeted to bankruptcy as liquidity completely dried up. Customers demanded withdrawals while Binance, a rival exchange, tore up its nonbinding agreement to purchase the now-defunct company.

According to Ray, a “substantial portion” of assets held with FTX appear to be “missing or stolen.”

“FTX has more than 1 million creditors, according to updated bankruptcy filings, hinting at the huge impact of its collapse on crypto traders and other counterparties with ties to Bankman-Fried’s empire,” CNBC reports.

In the comments, one of our own readers wrote that FTX and these other crypto scam corporations are little more than a “money laundering scheme” that is finally being “busted wide open.”

More of the latest news about the downfall of globalist-controlled finance as we currently know it can be found at Collapse.news.

Sources for this article include:

Submit a correction >>

Tagged Under:

bankruptcy, bitraped, BlockFi, Bubble, Chapter 11, conspiracy, crypto, cryptocult, currency crash, debt bomb, debt collapse, deception, deep state, economic collapse, finance riot, fraud, FTX, money supply, risk

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 BITCOIN CRASH NEWS