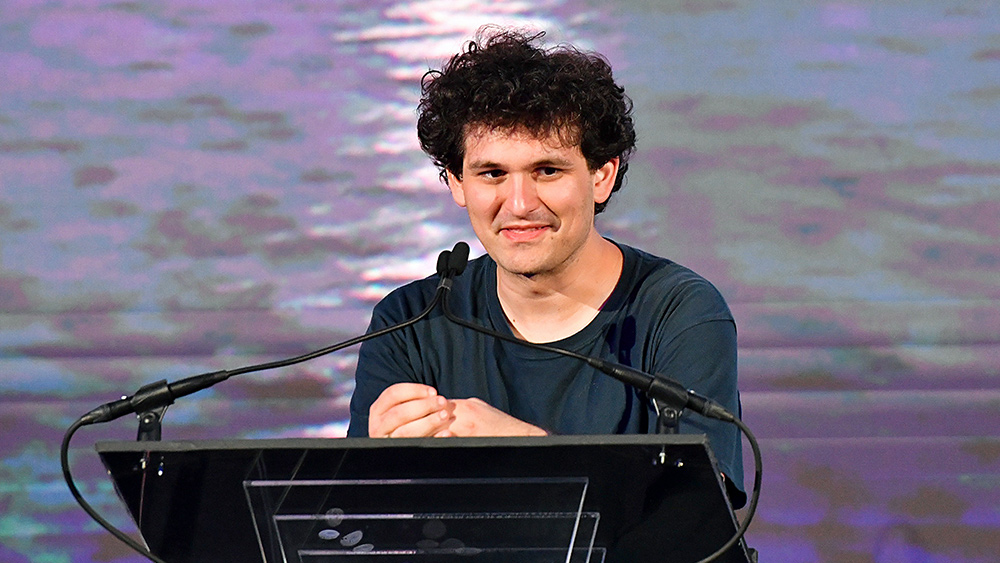

US to extradite embattled FTX ex-CEO Sam Bankman-Fried from Bahamas

11/18/2022 / By Cassie B.

The founder of crypto exchange FTX, Sam Bankman-Fried, is expected to be extradited from the Bahamas back to the U.S. as $2 billion of clients’ money remains unaccounted for. This is according to a report from Bloomberg, which says that authorities in the U.S. and the Bahamas have been discussing extraditing him for questioning.

Bankman-Fried has found himself in the middle of a major controversy after his crypto exchange was revealed to be funneling money to a sister trading company, Alameda Research, that is run by the 30-year-old’s girlfriend, Caroline Ellison.

Sources told Bloomberg that Bahamian and American authorities have been holding intense discussions in recent days as they investigate the role Bankman-Fried played in the collapse of FTX. He is reportedly cooperating with Bahamian officials.

After losing billions of dollars of customers’ money, Bankman-Fried resigned from his position as CEO and issued an apology to clients on Twitter. Meanwhile, his personal net worth, which estimates placed at $16 billion before this fiasco, has fallen by 94%.

Meanwhile, FTX continues bankruptcy proceedings in American courts, while other cryptocurrency firms are widely expected to follow suit. For example, BlockFi, a crypto lender that is associated with FTX, intends to lay off workers and file for bankruptcy.

Embattled CEO was a top Democrat donor

Bankman-Fried has reportedly donated $50 million to Democrats in the last two years and was the party’s second-biggest donor last year. He is the son of two professors at Stanford University School of Law. Somewhere between $1 and $2 billion worth of client funds have gone missing since the crypto exchange collapsed and filed for bankruptcy.

At the height of its popularity, FTX was endorsed by celebrities such as Seinfeld co-creator Larry David, NBA player Stephen Curry, supermodel Gisele Bundchen and NFL player Tom Brady.

Meanwhile, cryptocurrency experts have warned those who have FTX accounts linked to personal bank accounts to change the passwords on their bank accounts right away due to a vulnerability to hacking.

Cryptocurrency pioneer Brock Pierce told the New York Post: “I don’t know if he’s the Madoff of this generation or the Enron of this generation, but a ton of people are very shocked and upset and didn’t see this coming. It’s going to have a terrible impact on the market as well as for customers of FTX who probably will be lucky to get even a small portion of their money back — and that won’t be for another four or five years at best.”

FTX is a digital currency exchange platform on which people can buy and sell a range of digital assets, including bitcoin. Founded in 2019, it quickly rose to prominence thanks to low trading fees and aggressive marketing tactics. It made it easy for people with little technological knowledge to invest in cryptocurrencies. Several major capital groups invested nearly $2 billion in the company.

Shortly after FTX launched, cryptocurrencies started to boom and their popularity took off. However, the market has since experienced a dramatic decline. FTX was largely unaffected, even as other platforms started closing down, until earlier this month when the full extent of its crisis and mismanagement of user funds came to light.

The new CEO of FTX, John Ray III, a restructuring expert who also oversaw the collapse of Enron, said he had never seen anything as bad as what happened with FTX.

In a filing with the Delaware bankruptcy court, he said: “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.”

He added that a “substantial portion” of the assets held by FTX are stolen or missing.

Sources for this article include:

Submit a correction >>

Tagged Under:

big government, bitcoin, bitraped, Bubble, conspiracy, corruption, crypto cult, crypto exchange, cryptocurrency, currency crash, debt bomb, debt collapse, deception, FTX, market crash, money supply, risk, Sam Bankman-Fried

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 BITCOIN CRASH NEWS